Getting My Life Insurance To Work

Table of ContentsSome Ideas on Life Insurance You Should KnowThe 6-Minute Rule for Life InsuranceThe 10-Second Trick For Life InsuranceThe Single Strategy To Use For Life Insurance

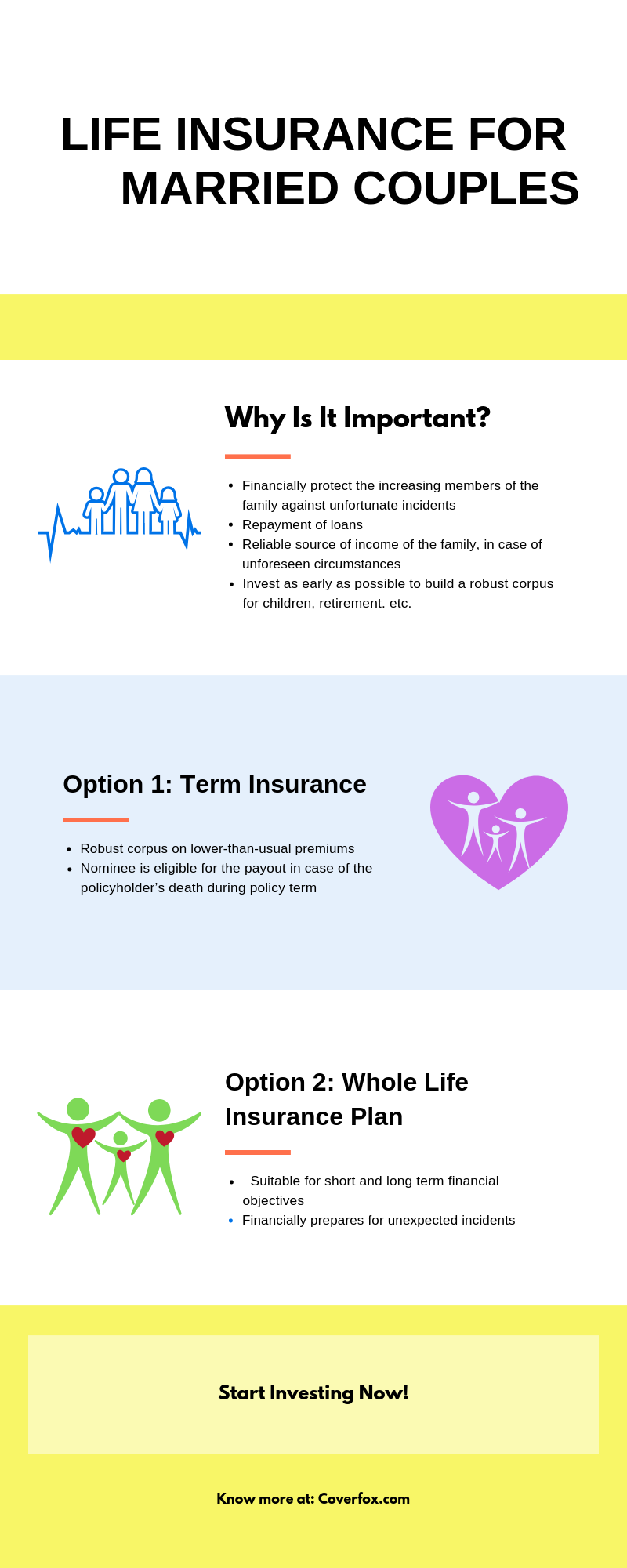

Usually, term insurance coverage policies are written for 1, 5, 10, or 20 years, or to a defined age (such as 65). Term plans only pay a fatality advantage to the recipient if the policyholder dies during the specified term and so is a great selection when the policyholder needs security for a short-lived time or a particular demand.There are a few different kinds of term life insurance policy plans: The most typical,, is identified by degree policy face amounts over the agreement term duration, usually 10, 20, or three decades. The survivor benefit quantity and policy amounts are normally guaranteed to stay degree during this time, no matter the insured's health and wellness standing.

An insurance policy holder might make use of these kinds of policies to cover financial responsibilities that reduce in time, such as a mortgage. warranties the insurance policy holder the right to renew at the end of the contract duration without evidence of insurability as long as the premium is paid. enables the insurance holder to convert a term insurance plan to a permanent insurance plan that will certainly construct cash worths in later years.

Term insurance policy policies can likewise have a feature which refunds part or every one of the premiums paid at the end of a level term duration if fatality benefits are not paid out. Plans with this attribute are more pricey because the insurance holder has the capacity to obtain cash money back. Entire life insurance policy gives a set amount of insurance policy coverage over the life of the insured, with the advantages payable just upon the insured's death.

The Basic Principles Of Life Insurance

As mandated by state legislation, whole life plans have nonforfeiture values payable in money or a few other form of insurance policy in case the plan gaps from nonpayment of called for costs or the plan owner decides to give up the insurance coverage. There are several kinds of whole life insurance policy policies. A does not pay dividends to the plan owner, but rather the insurer establishes the level costs, fatality advantages as well as money surrender values at the time of acquisition.

Universal life insurance policy is permanent life insurance policy combining term insurance with a cash account making tax-deferred passion. Under the majority of agreements, premiums and/or survivor benefit can change visit this page at insurance holder discernment. The policy remains in impact as long as the money worth is adequate to cover the expense of insurance as well as car loans can be taken versus the cash money value of the plan.

The interest built up under these agreements are not assured and might actually be unfavorable since rate of interest is a feature of the change out there worth of the different account assets. Recent years have actually seen the increase of, which have both dealt with and variable attributes. Under these plans, interest credit reports are linked to external index of investments, such as bonds or the S&P 500.

Facts About Life Insurance Uncovered

Life insurance policy as well as are managed by state insurance commissioners. The NAIC encourages states to embrace as well as policies developed to educate as well as safeguard insurance coverage consumers. The NAIC Life Insurance Policy (# 580) calls for insurance companies to supply to purchasers of life insurance policy info that will enhance the buyer's understanding of the plan as well as capability to pick one of the most ideal plan for the customer's requirements.

Term life insurance policy is planned to provide lower-cost coverage for a specific period as well as generally have reduced costs in the very early years, yet do not develop up a cash money value that you can access. Term life policies might include a provision that enables coverage to proceed (renew) at the end of the term, even if your health condition has altered.

These plans also have cost savings or financial investment functions, which make it possible for plan owners to get money from the plan while they're still click this link to life - life insurance. Entire life, universal life, and also variable life are kinds of cash money value policies. In some money value policies, the worths are low in the early years however develop later.

The Main Principles Of Life Insurance

A term life policy might be one of the most easy, straightforward choice for life insurance policy for lots of people. A survivor benefit can change the revenue you would certainly have gained throughout a set duration, such as till a small aged dependent matures. Or, it can repay a large financial debt, such as a home loan, to make sure that a surviving partner or various other heirs will not have to fret about making the repayments.

There are different types of term life, consisting of level term as well as reducing term.